The nephrology community is poised for revolutionary change in the way we are incentivized to care for our patients. In July 2019, the President of the United States unveiled a new executive order, Advancing American Kidney Health, that will link outcomes to various performance measures; quality indicators; and most significantly, financial incentives. The latter is key, because the Centers for Medicare & Medicaid Services (CMS) and other stakeholders have recognized that prudent financial incentives are necessary to alter clinical practice and patient outcomes.

While we await the granular details about the ESRD Treatment Choices and Kidney Care Choices models, let's look back at how *imprudent* financial incentives played a role in clinical care.

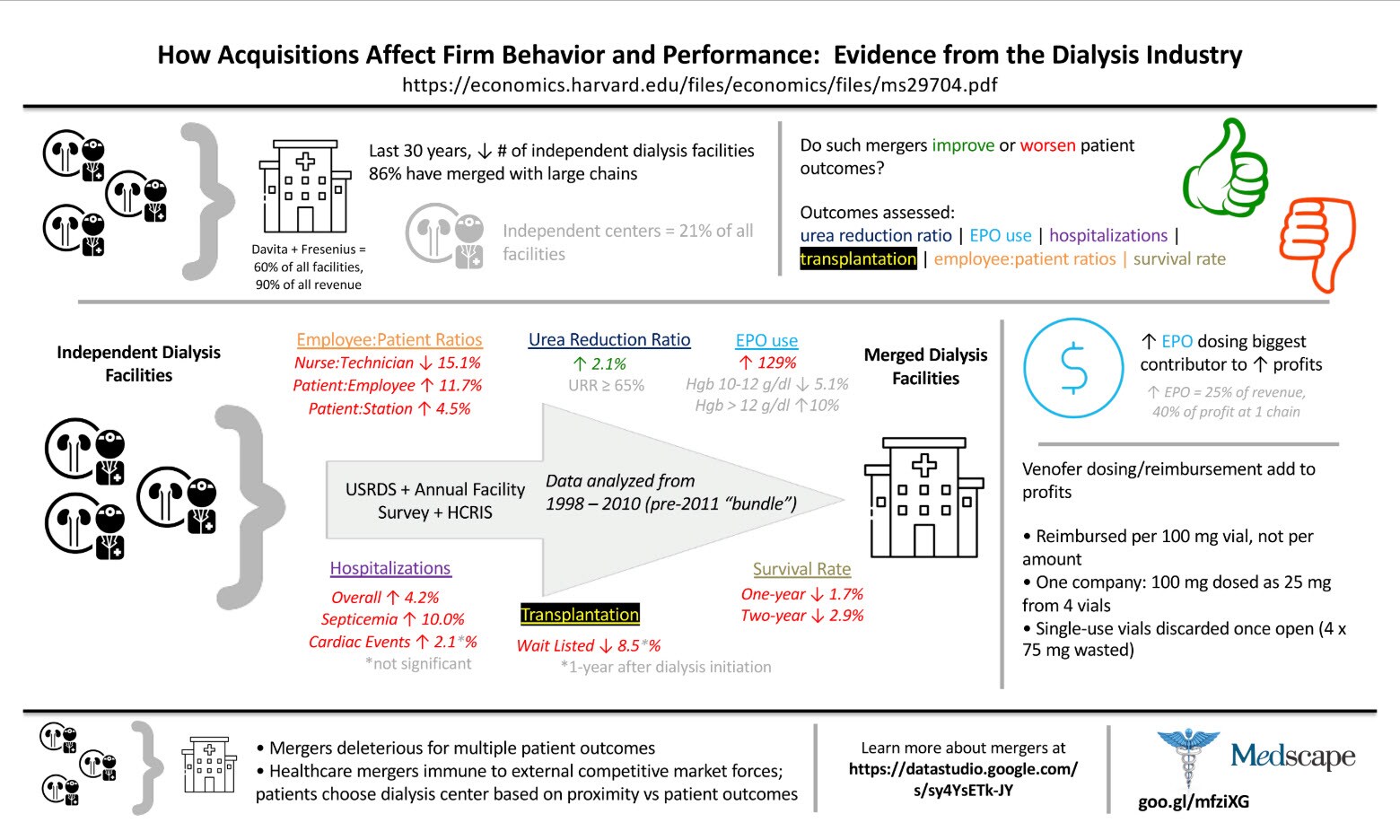

Usual Benefits of Mergers Not Seen

Economists from Duke University's Fuqua School of Business took a deep dive into the financial incentivesunder which dialysis providers operated from 1998 to 2010. This was a time in which the dialysis landscape dramatically changed. Large dialysis organizations (LDOs) became increasingly prevalent and powerful as they consolidated multiple independent dialysis facilities. Nearly 9 out of 10 previously independent dialysis facilities merged. Eventually, 60% of all dialysis facilities were controlled by one of two LDOs and only 21% of facilities were still considered "independent."